If you believe someone owes you money—or if you are being threatened with a lawsuit over an old debt—one of the first legal questions is often:

Is it too late to sue?

In Texas, most civil claims are subject to strict filing deadlines called statutes of limitations. If a lawsuit is filed after the deadline expires, courts will usually dismiss it, no matter how strong the underlying claim may be.

This article explains how Texas limitation periods work for contracts, debts, and related financial disputes, and why timing can make or break your case.

What Is a Statute of Limitations?

A statute of limitations is a law that sets the maximum amount of time a person has to file a lawsuit after a legal claim arises.

Texas law states:

“A person must bring suit not later than the second anniversary of the day the cause of action accrues.”

— Texas Civil Practice & Remedies Code § 16.003(a)

Different types of cases have different deadlines. Missing the deadline can permanently bar recovery.

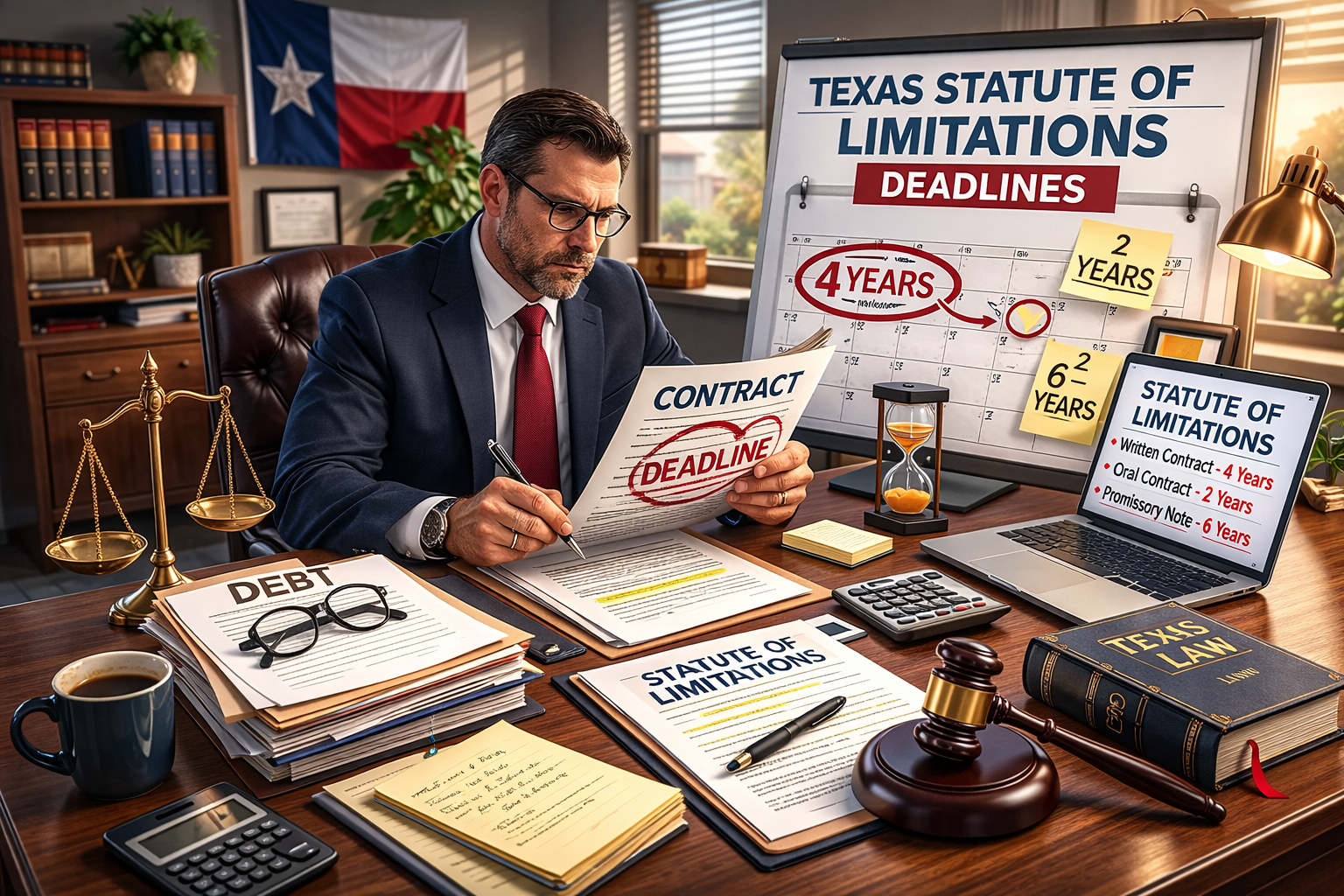

Statute of Limitations for Contract Claims in Texas

Written Contracts – Four Years

Most written contract claims must be filed within four years.

“A person must bring suit on the following actions not later than four years after the day the cause of action accrues:

(1) specific performance of a contract for the conveyance of real property;

(2) penalty or damages on the penal clause of a bond;

(3) debt;

(4) fraud; and

(5) breach of contract.”

— Texas Civil Practice & Remedies Code § 16.004(a)

This applies to:

- Promissory notes

- Leases

- Business contracts

- Settlement agreements

- Many loan agreements

If your claim is based on a signed agreement, the four-year rule usually controls.

Oral Contracts – Two Years

Oral (verbal) contracts generally fall under the two-year statute:

“A person must bring suit…for trespass for injury to the estate or to the property of another…or for taking or detaining the personal property of another…not later than two years…”

— Texas Civil Practice & Remedies Code § 16.003(a)

Courts often apply this two-year rule to unwritten agreements.

Because oral contracts are harder to prove, they are more vulnerable to limitations defenses.

Statute of Limitations for Debt Collection in Texas

Debt collection cases are among the most common civil lawsuits in Texas. The applicable deadline depends on the type of debt.

Most Consumer Debts – Four Years

Texas law treats most consumer debts as “debt” under § 16.004, meaning a four-year limitations period applies.

This includes:

- Credit cards

- Personal loans

- Auto loans

- Medical bills

- Lines of credit

If a creditor waits more than four years after default, the debt may become legally unenforceable in court.

Promissory Notes – Six Years (In Some Cases)

Under the Texas Business & Commerce Code (UCC), some negotiable instruments have longer deadlines:

“An action to enforce the obligation of a party to pay a note payable at a definite time must be commenced within six years…”

— Tex. Bus. & Com. Code § 3.118(a)

This often applies to formal promissory notes used in business and real estate transactions.

When Does the Clock Start Running?

The statute of limitations begins when the claim “accrues.”

Texas law provides:

“A cause of action accrues when facts come into existence that authorize a claimant to seek a judicial remedy.”

— Provident Life v. Knott, 128 S.W.3d 211 (Tex. 2003)

In debt and contract cases, this usually means:

- The date of default

- The date of missed payment

- The date of breach

- The date payment was demanded and refused

Example:

If a borrower stopped paying in March 2022, the creditor’s four-year deadline may expire in March 2026.

Can the Statute of Limitations Be Restarted?

Yes. In certain situations, the limitations period can be revived.

Written Acknowledgment or New Promise

Texas law allows revival when a debtor signs a written acknowledgment:

“An acknowledgment of the justness of a claim…must be in writing and signed…”

— Texas Civil Practice & Remedies Code § 16.065

This may occur when:

- A debtor signs a settlement

- Agrees to a payment plan

- Confirms the debt in writing

A proper acknowledgment can restart the clock.

Partial Payments

In some cases, making a payment can restart limitations if it reflects acknowledgment of the debt.

However, this is a highly technical area and often litigated.

What Happens If You Are Sued After Limitations Expire?

If a creditor or claimant sues after the deadline, you may raise limitations as an affirmative defense.

Texas Rule of Civil Procedure 94 requires defendants to plead this defense.

If properly raised and proven, the court may:

- Dismiss the case

- Grant summary judgment

- Bar recovery entirely

Important: Courts do not apply limitations automatically. You must assert it.

Common Mistakes in Limitations Cases

Many people lose valid claims—or defenses—because of avoidable errors:

1. Waiting Too Long to Act

Assuming “I still have time” without confirming deadlines.

2. Miscalculating Accrual Dates

Using the wrong starting date.

3. Relying on Old Collection Letters

Threat letters do not extend limitations.

4. Signing the Wrong Documents

Accidentally reviving expired debts.

5. Ignoring Lawsuits

Default judgments can be entered even on time-barred claims.

Why Statutes of Limitations Matter in Practice

For creditors and plaintiffs:

- Filing too late destroys leverage

- Valuable claims may be lost forever

For defendants and debtors:

- Limitations may provide a complete defense

- Old debts may be legally unenforceable

In both cases, understanding deadlines protects your rights.

When Should You Talk to a Texas Attorney?

You should seek legal advice if:

- You are being sued on an old debt

- You are considering filing a contract lawsuit

- You received collection threats

- You are unsure when default occurred

- You may have revived a debt

Limitations law is technical. Small errors can cost thousands of dollars.

Final Thoughts

Texas statutes of limitations place strict time limits on debt and contract claims. In most cases:

- Written contracts: 4 years

- Consumer debts: 4 years

- Oral contracts: 2 years

- Some notes: 6 years

But accrual dates, tolling, and revival rules can dramatically change outcomes.

If you are dealing with an aging debt or delayed claim, professional guidance can make the difference between winning and losing.

At David C. Barsalou, Attorney at Law, PLLC, we help clients navigate business, family, tax, estate planning, and real estate matters ranging from document drafting to litigation with clarity and confidence. If you’d like guidance on your situation, schedule a consultation today. Call us at (713) 397-4678, email barsalou.law@gmail.com, or reach us through our Contact Page. We’re here to help you take the next step.