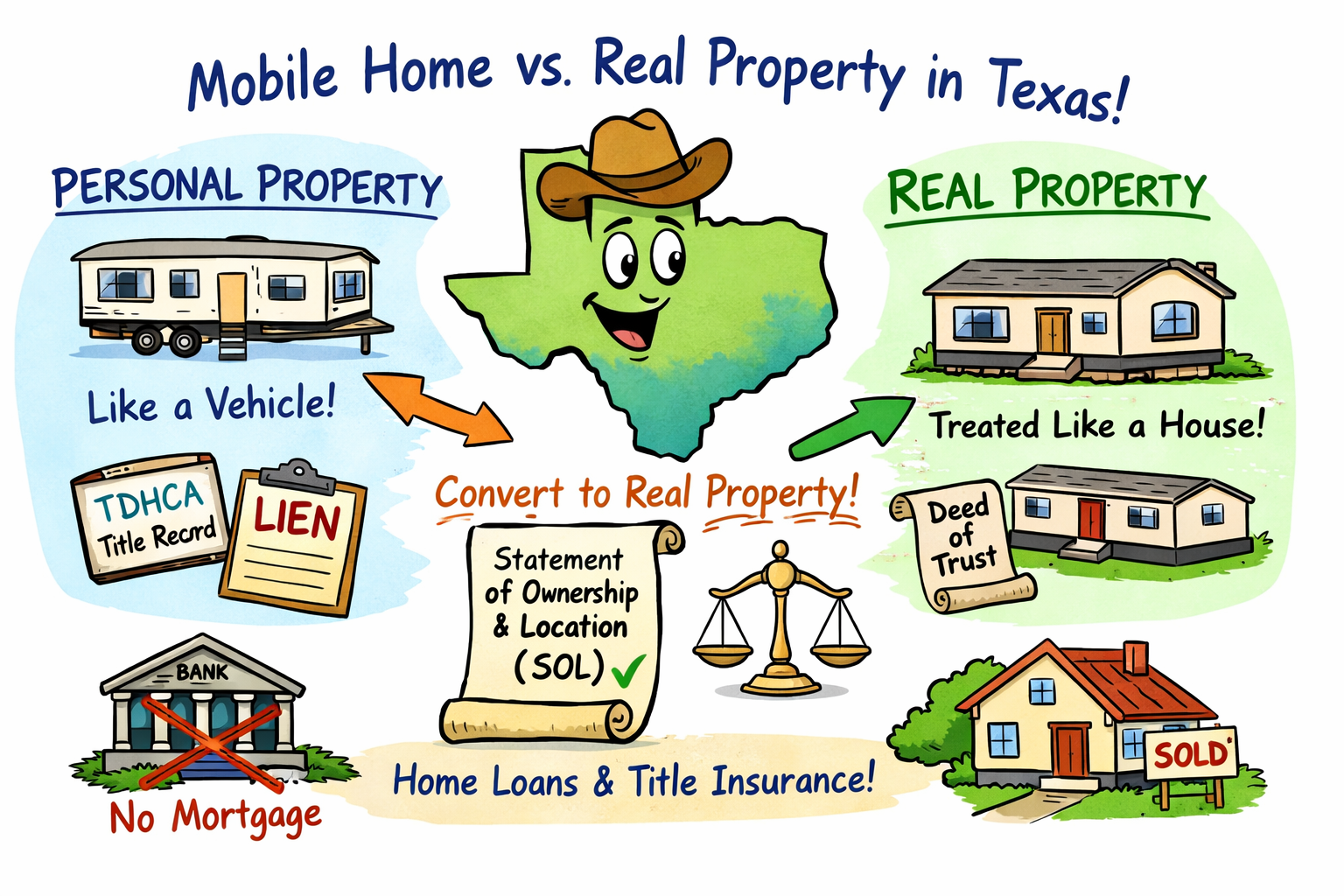

In Texas, a “mobile home” is usually treated as a manufactured home for legal purposes—and the big issue is this:

- By default, a manufactured home is generally treated as personal property (more like a vehicle than a house), unless the owner properly elects to treat it as real property.

- To convert it into real property, Texas law relies heavily on a Statement of Ownership and Location (SOL) and a real property election process administered through the Texas Department of Housing and Community Affairs (TDHCA) under Texas Occupations Code Chapter 1201.

That classification decision matters in real life: financing, title insurance, lien perfection, homestead claims, foreclosure mechanics, taxes, and even how the property is described and conveyed.

1) Why classification matters

If the manufactured home is personal property

It tends to be tracked like titled property through TDHCA records, and liens are typically handled through that system—not necessarily through county real property records. Practically, this can complicate conventional mortgage lending and closings.

If the manufactured home is real property

The home is treated as part of the land (think: “house on the land”), and lenders/closing attorneys typically want the home to be covered by a deed of trust and handled within normal real-property conveyancing and title practices. Texas law specifically provides for an owner electionto treat the home as real property, tied to county filing.

2) The legal mechanism: the Real Property Election + SOL

Texas Occupations Code § 1201.2055 authorizes an owner’s election to treat a manufactured home as real property.

A key practice point from the statute: the real-property election is not “perfected” until the SOL reflecting the election is filed in the county real property records and the required notifications are made.

In other words: it’s not just “bolting it down.” The conversion is primarily a paperwork + recording process that makes the status legally recognizable to third parties.

3) Step-by-step: how conversion commonly works in Texas

While facts vary (new vs. used home, liens, land ownership, leasehold, etc.), the usual path looks like this:

Step 1: Confirm ownership and lien status in TDHCA records

Before you do anything else, verify:

- the correct owner of record,

- any existing liens,

- the correct serial/HUD label/Texas Seal numbers.

TDHCA explicitly recommends researching department records before transfers and SOL submissions.

Step 2: Prepare and submit the Application for Statement of Ownership

This is the core TDHCA form package that includes the “Election”section—where the owner selects Real Property (and specifies whether they own the land or have a qualifying long-term lease, as applicable).

Step 3: Address liens (if any)

If there’s a lender lien on the home as personal property, the lender/closing will often require payoff, releases, or coordination so the home can be treated consistently with the intended financing structure.

Step 4: Obtain the SOL showing the real property election

Once processed, the SOL should reflect that the home is elected to be treated as real property at the listed location.

Step 5: Record the SOL in the county real property records

This is the “public notice” step that helps make the election effective against third parties. Texas law ties perfection of the real property election to county filing.

Step 6: Notify/coordinate with the appraisal district (tax roll treatment)

The statute contemplates notification in connection with perfection.

Separately, local tax offices often emphasize that title/ownership/location changes run through TDHCA and then interact with local taxation processes.

Step 7: For financed transactions: closing affidavits often appear

In many mortgage closings, you’ll see TDHCA-related affidavits used to support the “real property” treatment in underwriting/closing packages (for example, TDHCA’s “Affidavit of Fact for Real Property” form is commonly used in closings involving manufactured homes).

4) Common pitfalls (where people get burned)

- “It’s on my land, so it’s automatically real property.”

Not necessarily. The legal conversion hinges on the election/recording process, not just physical attachment. - Old liens that don’t match the new plan.

If a lien exists in TDHCA records, it can block or complicate conversion, refinance, sale, or title insurance. - Mismatch in ownership between the land and the home.

Title/underwriting frequently expects clean alignment between (a) land ownership and (b) home ownership—especially for “treat as real property” financing structures. - Skipping county recording.

The statute’s “perfected” language makes recording a central step—not a formality.

5) Practical takeaways for Texas owners (and their lawyers)

If your goal is: sell like a house, finance like a house, insure/title like a house—then you usually want the home treated as real property, and you need to complete the SOL + real property election + county recording pathway.

If your goal is: move it, keep it titled separately, or avoid blending it with the land, personal property status may be acceptable—but you should understand how that affects lending and lien/transfer mechanics.

Disclaimer

This is general information for Texas and isn’t legal advice for your specific situation. Manufactured home conversion can turn on lien status, land tenure, county recording practices, and lender/title requirements.

At David C. Barsalou, Attorney at Law, PLLC, we help clients navigate business, family, tax, estate planning, and real estate matters ranging from document drafting to litigation with clarity and confidence. If you’d like guidance on your situation, schedule a consultation today. Call us at (713) 397-4678, email barsalou.law@gmail.com, or reach us through our Contact Page. We’re here to help you take the next step.