Few legal concepts in Texas are as powerful—or as misunderstood—as the homestead exemption. Many Texans casually say, “They can’t take my house—it’s my homestead,” but the truth is more nuanced. Texas homestead law provides extraordinary protections, but those protections are not unlimited, automatic in all situations, or immune from common mistakes.

Understanding what the Texas homestead exemption does, does not, and can accidentally lose is critical for homeowners, business owners, and families alike.

What Is a Texas Homestead?

In simple terms, a homestead is your primary residence—the place you actually live and intend to remain living. Texas law recognizes two types:

- Urban homestead – generally up to 10 acres

- Rural homestead – up to 100 acres for a single adult or 200 acres for a family

These limits are grounded in the Texas Constitutionand implemented through the Texas Property Code.

The Core Legal Protection

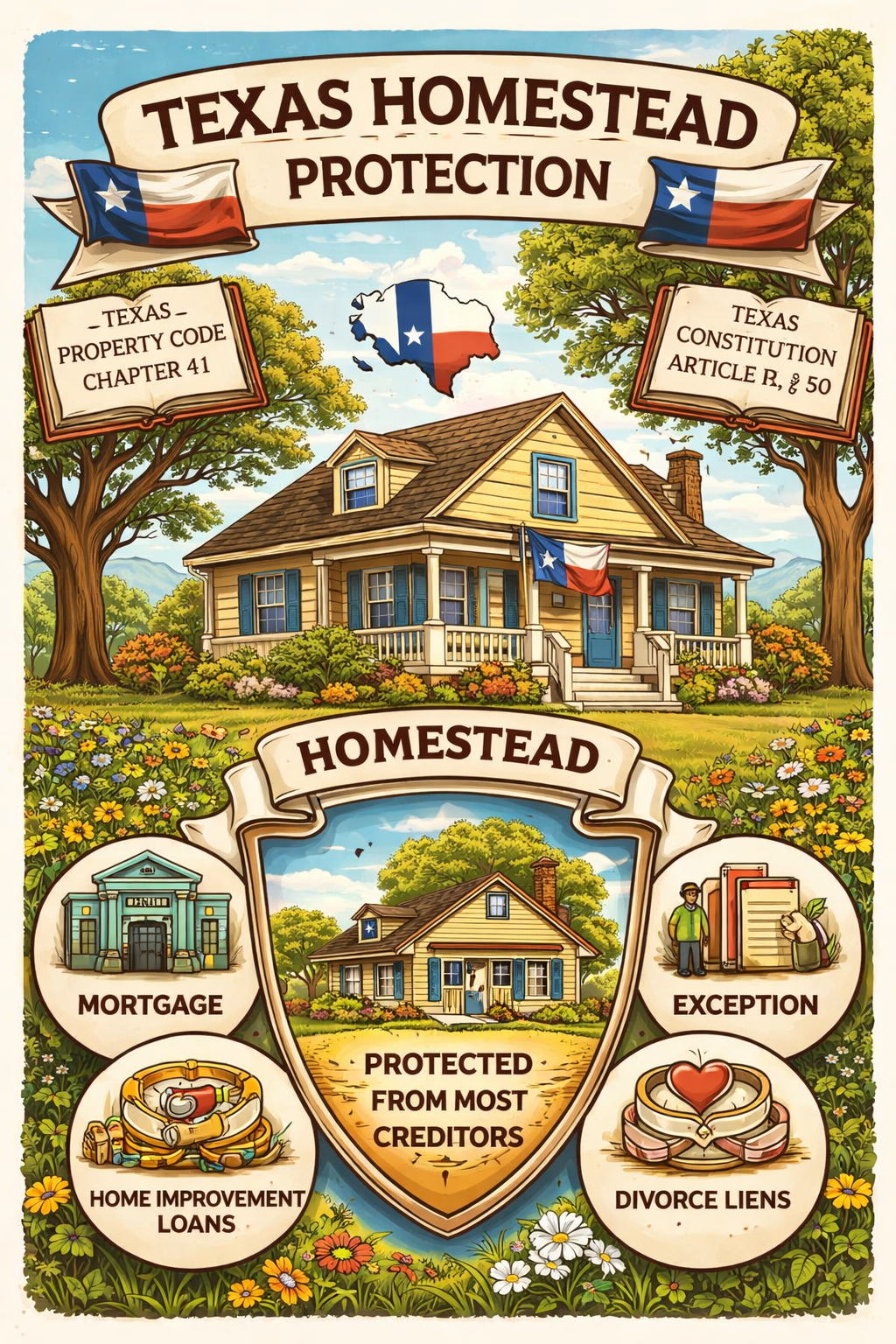

Texas homestead protections come from two main sources:

- Texas Constitution, Article XVI, § 50

- Texas Property Code Chapter 41

Together, they provide that a qualifying homestead is generally exempt from forced sale to satisfy most debts.

That means most judgment creditors cannot seize or force the sale of your homestead, even if they win a lawsuit against you.

This is one of the strongest homeowner protections in the United States.

Debts That Can Penetrate the Homestead

This is where people get tripped up.

Even a valid Texas homestead can be foreclosed uponfor certain constitutionally allowed debts, including:

- Purchase-money mortgages

- Property taxes

- Home equity loans (only if they strictly comply with constitutional requirements)

- Mechanic’s and materialman’s liens for work improving the homestead

- Owelty liens from divorce property divisions

If the debt fits into one of these categories, the homestead shield does not apply.

Common Homestead Myths (and Costly Mistakes)

❌ “I filed a homestead exemption, so I’m fully protected.”

The county tax homestead exemption helps with taxes, but homestead status exists by law, not by filing. Filing helps prove intent—but it isn’t the source of protection.

❌ “Putting my house in an LLC is safer.”

Often false. Transferring a homestead into an LLC can destroy homestead protection entirely if not structured properly.

❌ “A judgment automatically becomes a lien on my house.”

Not in Texas. A judgment does not automatically attachto a homestead unless the debt qualifies under the constitutional exceptions.

How Homestead Status Is Established

Texas courts look at facts, not labels. The key factors are:

- Actual use of the property as a residence

- Intent to remain

- Absence of abandonment

Temporary absences (work, illness, repairs) generally do notdestroy homestead status—but renting it out long-term or moving permanently often will.

Why This Matters in Real Life

Homestead issues frequently arise in:

- Divorces

- Creditor lawsuits

- Estate planning

- Probate disputes

- Business failures

- Judgment enforcement fights

Many people only discover the limits of their homestead protection after something goes wrong—when options are already narrower.

Final Thought

Texas homestead law is incredibly protective—but it is also technical, fact-driven, and unforgiving of casual assumptions. The strongest protections in Texas law only work if they are preserved intentionally.

If you’re relying on your homestead as an asset shield, it’s worth understanding exactly what protects it—and what can quietly undo it.

At David C. Barsalou, Attorney at Law, PLLC, we help clients navigate business, family, tax, estate planning, and real estate matters ranging from document drafting to litigation with clarity and confidence. If you’d like guidance on your situation, schedule a consultation today. Call us at (713) 397-4678, email barsalou.law@gmail.com, or reach us through our Contact Page. We’re here to help you take the next step.