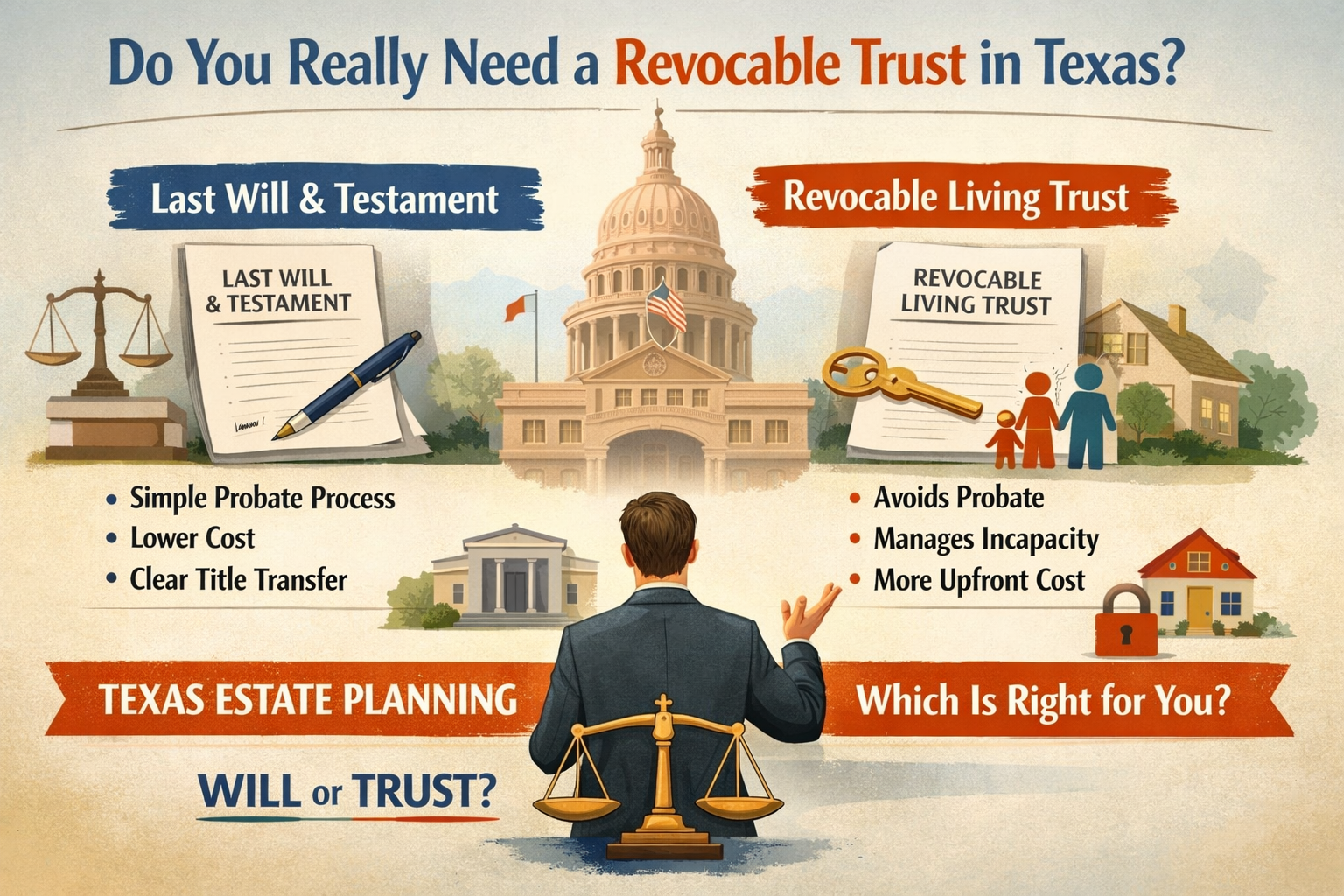

If you’ve attended an estate planning seminar, received mailers, or seen online ads recently, you may have been told that everyoneneeds a revocable living trust. That claim is common — and often misleading.

The truth is: many people in Texas do not need a revocable trust, and for some families, a properly drafted will and probate proceeding is the simpler, more cost-effective option.

This article explains when a revocable trust makes sense, when it does not, and what many sales pitches leave out.

What Is a Revocable Living Trust?

A revocable living trust is an estate planning tool that allows you to transfer assets into a trust during your lifetime while retaining full control. You can amend or revoke it at any time, and upon death, assets held in the trust generally avoid probate.

Revocable trusts can be useful — but they are not a universal solution.

When a Revocable Trust Can Be Helpful

A revocable trust may be appropriate in certain circumstances, including:

- Owning real estate in multiple states

- Wanting ongoing asset management in the event of incapacity

- Seeking probate avoidance for specific assets

- Managing complex family or distribution arrangements

In those situations, a trust can simplify administration and reduce delays.

What Many People Are Not Told About Revocable Trusts

Here are key facts often omitted from trust sales presentations:

❌ No Estate Tax Savings

A revocable trust does not reduce estate taxes. Assets in the trust are still part of your taxable estate.

❌ No Income Tax Benefits

There are no income tax advantages to a revocable living trust during your lifetime.

❌ Added Cost and Maintenance

Trusts require:

- Proper funding

- Ongoing management

- Deeds, retitling, and follow-up documentation

For many people, this adds cost without corresponding benefit.

Probate in Texas Is Often Simpler Than Advertised

In Texas, probate is frequently straightforward, efficient, and affordable, especially with proper planning.

Probate is not merely about distributing assets — it is the legal process that officially closes a person’s life on paper. Even when assets are limited, probate:

- Clears title to real property

- Closes financial accounts

- Creates a public legal record

- Prevents future disputes and uncertainty

Avoiding probate is not always the best or cheapest strategy.

The Problem With “Everyone Needs a Trust” Sales Pitches

Unfortunately, some companies and non-lawyer advisers promote revocable trusts as a one-size-fits-all product, often selling expensive packages to people whose estates could be handled more efficiently with a will.

Estate planning should be individualized, not sold under pressure.

Honest Estate Planning Options and Transparent Pricing

At David C. Barsalou, Attorney at Law, PLLC, I focus on practical, cost-effective estate planning — not sales tactics.

- Simple wills starting at $275

- Revocable and irrevocable trusts starting at $1,050

- Clear explanations and tailored advice based on your circumstances

If you need a trust, I will tell you — and prepare it affordably.

If you don’t, I will tell you that too.

The Bottom Line: Do You Really Need a Revocable Trust?

A revocable living trust can be the right tool in the right situation, but it is not automatically necessary, especially in Texas.

Before paying thousands for a trust, speak with an experienced estate planning attorney who can explain all available optionsand help you choose the approach that truly fits your goals, assets, and family.

At David C. Barsalou, Attorney at Law, PLLC, we help clients navigate business, family, tax, estate planning, and real estate matters ranging from document drafting to litigation with clarity and confidence. If you’d like guidance on your situation, schedule a consultation today. Call us at (713) 397-4678, email barsalou.law@gmail.com, or reach us through our Contact Page. We’re here to help you take the next step.