How Long It Lasts, Who It Affects, and What Property Can Be Taken

Receiving notice of a judgment can be unsettling. Many Texans assume it means their home, wages, or family finances are immediately at risk. In reality, Texas law provides some of the strongest protections in the country for judgment debtors—but understanding those protections requires separating myth from law.

This article explains how long judgments last in Texas, who they affect within a household, and what property may (and may not) be taken to satisfy them.

How Long a Judgment Lasts in Texas

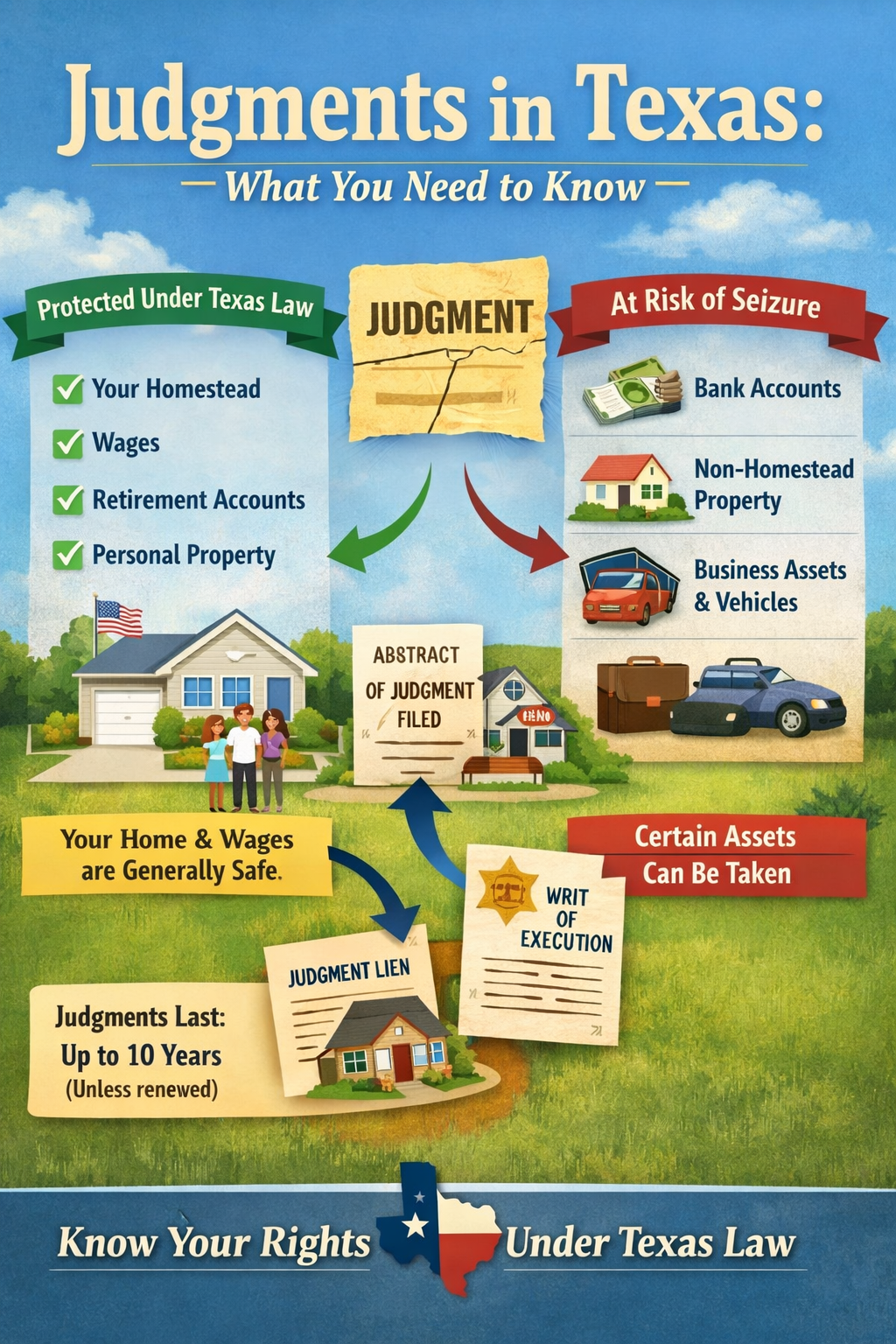

In Texas, a civil judgment is generally valid for 10 years from the date it is signed. During that time, a creditor may attempt to enforce it through lawful collection methods.

If no enforcement action is taken within that period, the judgment can become dormant. A dormant judgment is not automatically erased, but it becomes unenforceable unless properly revived. (This revival process is governed by strict deadlines and procedural rules.)

Key point:

A judgment does not disappear quickly—but it does not follow you forever without action by the creditor.

Who a Judgment Affects in Your Household

One of the most common misconceptions is that a judgment against one person automatically affects everyone living with them. That is not how Texas law works.

A Texas judgment generally affects:

- Only the named judgment debtor

- Only property legally owned by that debtor

A judgment does not automatically attach to:

- A spouse’s separate property

- A spouse’s wages

- Adult children

- Other household members

- Non-owners living in the home

Texas community property rules can complicate matters in some situations, particularly for debts incurred during marriage. Even then, Texas homestead and exemption laws often provide decisive protection.

The Difference Between a Judgment and a Judgment Lien

A judgment by itself does not automatically attach to real property.

To create a lien on non-exempt real estate, a creditor must:

- Obtain a judgment

- Prepare an abstract of judgment

- Record it in the county where the property is located

Even after this step, a lien does not override Texas homestead protections.

This distinction is critical, particularly in real estate transactions, refinances, and probate matters where title issues arise.

What Property Can Be Taken to Satisfy a Judgment

Judgment enforcement in Texas is formal and regulated. Creditors cannot simply “take” property at will.

Potentially reachable assets may include:

- Non-exempt bank accounts

- Non-exempt investment accounts

- Non-homestead real estate

- Certain business assets

- Vehicles exceeding exemption limits

Actual seizure typically requires:

- A writ of execution

- Service by a sheriff or constable

- Strict statutory compliance

Many judgments are never enforced beyond paper filings.

What Property Is Protected Under Texas Law

Texas provides exceptionally strong exemptions for judgment debtors.

Generally protected property includes:

- Your homestead (urban or rural)

- Wages

- Retirement accounts

- Social Security and government benefits

- Household furnishings (within statutory limits)

- Tools of trade

- Vehicles (subject to limits)

For most individuals, these protections mean that the practical impact of a judgment is far more limited than they fear.

Can a Judgment Force the Sale of a Texas Homestead?

In nearly all consumer judgment situations, no.

Texas law does not permit forced sale of a homestead to satisfy ordinary judgments. Limited exceptions exist, such as:

- Purchase-money mortgages

- Property taxes

- Certain statutory liens (e.g., mechanics’ liens)

- Some HOA assessments

Standard lawsuit judgments do not qualify.

How Judgments Usually Play Out in Real Life

In practice, many creditors:

- Record a judgment or abstract

- Wait to see if the debtor sells or refinances property

- Use the judgment as leverage for later negotiation

Judgments often rely more on psychological pressurethan actual asset seizure.

Final Thoughts

Judgments are serious—but they are not the financial death sentence many people imagine. Texas law draws firm lines around what creditors can and cannot reach, particularly when it comes to homes, wages, and family security.

Understanding those limits early can prevent unnecessary panic and costly mistakes.

If you have questions about judgment exposure, enforcement, or how a judgment may affect your property or household under Texas law, speaking with counsel sooner rather than later can make a significant difference.

At David C. Barsalou, Attorney at Law, PLLC, we help clients navigate business, family, tax, estate planning, and real estate matters ranging from document drafting to litigation with clarity and confidence. If you’d like guidance on your situation, schedule a consultation today. Call us at (713) 397-4678, email barsalou.law@gmail.com, or reach us through our Contact Page. We’re here to help you take the next step.