If you’ve recently left a job in Texas—whether you quit or were fired—you may be wondering:

“When am I supposed to get my last paycheck?”

Texas law sets strict deadlines for when employers must pay departing employees. When companies ignore these rules, they can face penalties and legal claims.

Here’s what Texas workers and employers need to know.

Texas Law on Final Paychecks

Final paychecks in Texas are governed by the Texas Payday Law, found in the Texas Labor Code.

📌 Texas Labor Code § 61.014

Under Section 61.014:

“An employer shall pay an employee who is discharged not later than the sixth day after the date of discharge.”

And:

“An employer shall pay an employee who leaves employment voluntarily not later than the next regularly scheduled payday.”

(Tex. Labor Code § 61.014)

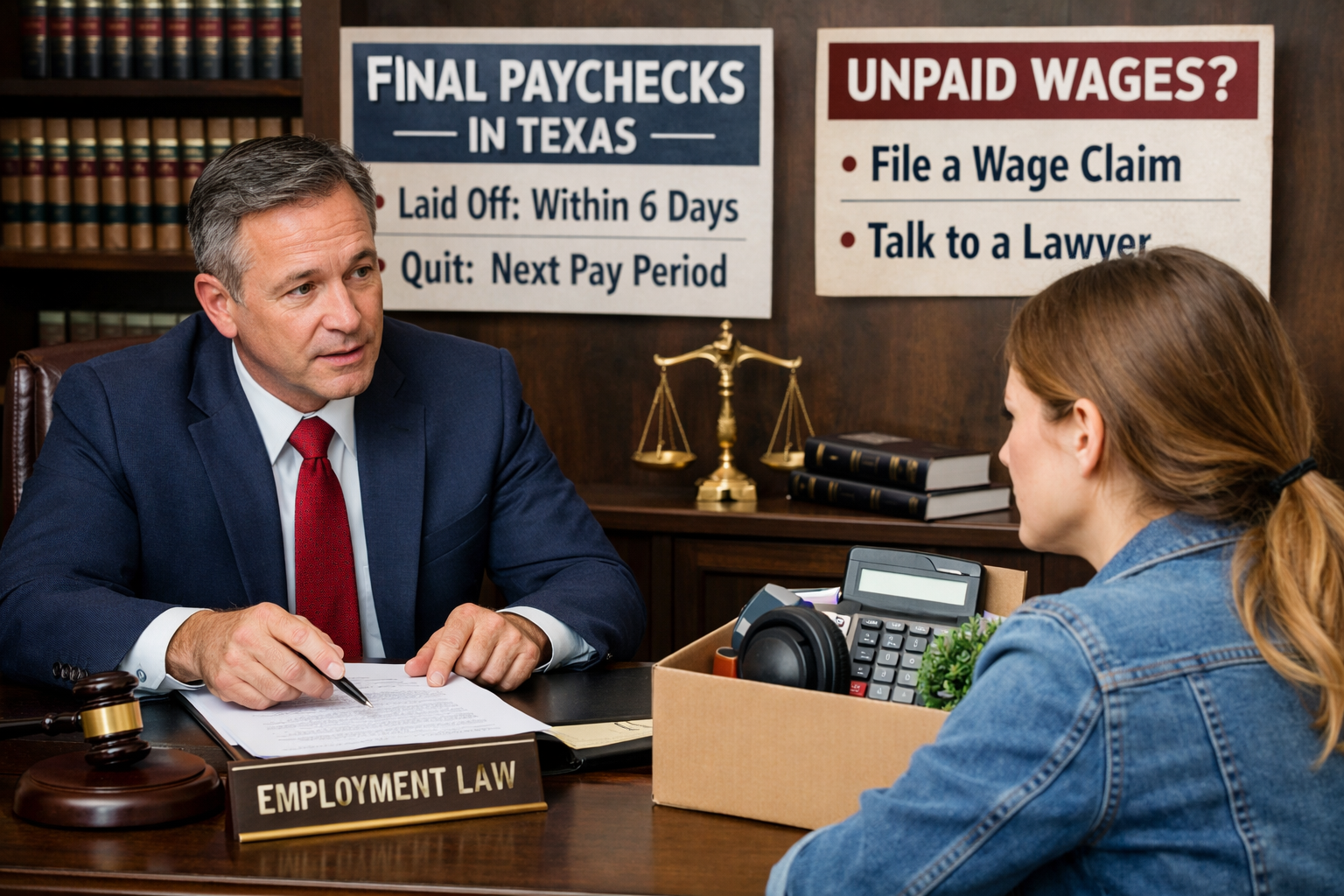

In simple terms:

How Employment Ended

Deadline to Pay

Fired / Laid Off

Within 6 days

Quit / Resigned

Next regular payday

Missing these deadlines can expose employers to liability.

What Counts as “Wages” in Texas?

Texas law defines “wages” broadly.

📌 Texas Labor Code § 61.001(7)

“Wages” include:

- Salary

- Hourly pay

- Commissions

- Bonuses (if promised)

- Overtime

- Vacation pay (if company policy allows)

(Tex. Labor Code § 61.001(7))

If the compensation was earned under company policy, it usually must be paid.

Can an Employer Withhold Your Final Paycheck?

Generally, no—unless the law allows it.

📌 Texas Labor Code § 61.018

Employers may not withhold wages unless:

- Required by law (taxes, garnishments), or

- Authorized in writing by the employee

(Tex. Labor Code § 61.018)

Common illegal deductions include:

❌ “Training fees”

❌ “Equipment losses”

❌ “Cash register shortages”

❌ “Customer walkouts”

Without written authorization, these deductions are usually unlawful.

What About Unused Vacation or PTO?

Texas does not require employers to provide vacation pay.

However:

If company policy says unused vacation is paid out, the employer must honor it.

Courts and regulators treat written policies as binding agreements.

How Final Paychecks Must Be Delivered

Employers may pay final wages by:

- Direct deposit

- Paper check

- Payroll card

- Mail (if agreed)

They may not unreasonably delay delivery.

A paycheck that exists but is inaccessible can still violate the law.

What If Your Employer Doesn’t Pay You?

If your employer misses the deadline, you have options.

1️⃣ File a Wage Claim

You may file a claim with the Texas Workforce Commission (TWC).

📌 Texas Labor Code § 61.051

An employee may file a wage claim within 180 days of nonpayment.

(Tex. Labor Code § 61.051)

The TWC can order payment and penalties.

2️⃣ File a Lawsuit

In some cases, filing suit is faster and more effective—especially when:

- Large sums are involved

- Multiple violations exist

- Retaliation is suspected

An attorney can help evaluate the best approach.

Can Employers Be Penalized?

Yes.

Late or unpaid wages can result in:

- Administrative penalties

- Interest

- Attorney’s fees

- Court costs

Repeated violations may trigger audits.

Retaliation Is Illegal

Employers may not punish workers for asserting wage rights.

📌 Texas Labor Code § 61.052

Retaliation for filing a wage claim is prohibited.

(Tex. Labor Code § 61.052)

This includes:

❌ Firing

❌Blacklisting

❌Threats

❌Reducing pay

Retaliation can create separate legal claims.

Common Final Paycheck Myths

❌ “They fired me, so they don’t have to pay me.”

False. Earned wages must be paid.

❌ “They’re holding my check for damages.”

Usually illegal.

❌ “I have to return equipment first.”

Not unless there’s a valid agreement.

❌ “They can wait until next month.”

Wrong. Deadlines are strict.

Practical Advice for Texas Workers

If you haven’t received your final paycheck:

1️⃣ Save pay stubs

2️⃣ Keep employment records

3️⃣ Request payment in writing

4️⃣ Document communications

5️⃣ Speak with a lawyer if needed

Documentation wins wage cases.

When to Speak With a Texas Employment Lawyer

You should consider legal advice if:

- Your check is more than a few days late

- Deductions seem improper

- PTO wasn’t paid per policy

- Retaliation occurred

- Multiple employees are affected

Early legal review often prevents long disputes.

Final Thoughts

Texas law protects employees’ right to timely payment. Employers who ignore these rules take unnecessary legal risks.

If you believe your employer has violated wage laws, speaking with an attorney early can help protect your rights and recover what you are owed.

At David C. Barsalou, Attorney at Law, PLLC, we help clients navigate business, family, tax, estate planning, and real estate matters ranging from document drafting to litigation with clarity and confidence. If you’d like guidance on your situation, schedule a consultation today. Call us at (713) 397-4678, email barsalou.law@gmail.com, or reach us through our Contact Page. We’re here to help you take the next step.