Many Texans believe that once a creditor “gets a judgment,” that creditor automatically has a lien on everything they own.

That assumption is understandable—but under Texas law, it is often wrong.

In reality, a judgment by itself usually does nothingto your property. Whether it becomes a lien depends on several additional legal steps, the type of property involved, and Texas’s unusually strong debtor protections.

This distinction matters enormously—for homeowners, business owners, and judgment creditors alike.

1. A Judgment Is Not the Same Thing as a Judgment Lien

In Texas, a judgment is simply a court’s determination that one party owes money to another. It establishes liability—but not collateral.

To turn a judgment into a lien on real property, a creditor must take additional statutory steps. Until those steps are properly completed, the judgment is often unenforceable against property, even if it is fully valid.

This is one of the most common—and costly—misunderstandings in Texas civil law.

2. What Actually Creates a Judgment Lien in Texas?

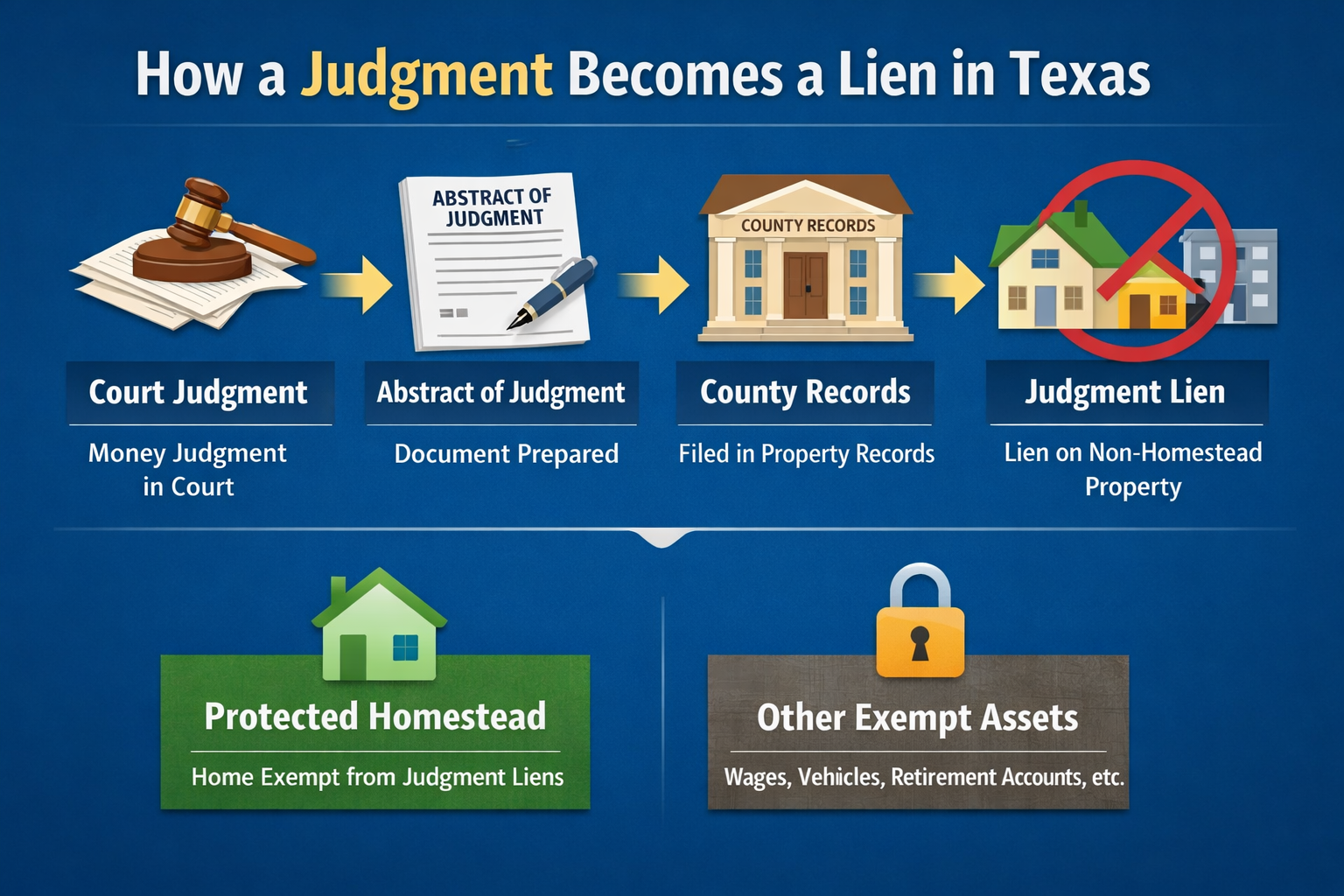

To create a lien on non-exempt real property, a creditor must:

- Obtain a final judgment

- Prepare an Abstract of Judgment

- Record the Abstract in the real property records of:

- Each county where the debtor owns real estate

Only after this process does a judgment lien potentially arise—and even then, only against non-exempt property.

A judgment that is never abstracted may exist for years without attaching to anything at all.

3. County Matters More Than People Think

Texas does not have a statewide judgment lien system.

An abstract of judgment recorded in Harris County:

- Creates no lien on property in Travis County

- Does nothing to property in Montgomery County

- Does not “follow” the debtor if they buy land elsewhere

Creditors must record county by county, and failures here are extremely common.

4. The Texas Homestead: The Biggest Limitation of All

Even when an abstract of judgment is properly recorded, Texas homestead property is generally exempt from judgment liens.

That means:

- A judgment lien typically cannot attach to a debtor’s homestead

- Recording an abstract does not override homestead protection

- The lien may appear in public records but still be legally unenforceable

There are narrow exceptions (such as taxes, purchase-money loans, owelty, and certain refinances), but most judgment creditors cannot force the sale of a Texas homestead.

This surprises both debtors and creditors.

5. What Property Can a Judgment Lien Attach To?

If properly abstracted, a judgment lien may attach to:

- Non-exempt real estate

- Investment property

- Rental property

- Vacant land

- Commercial property

It does not generally attach to:

- Homestead property

- Most personal property

- Wages

- Retirement accounts

- Tools of trade (with limits)

Texas remains one of the most debtor-protective states in the country.

6. Why Judgment Liens Still Matter (Even When They Can’t Be Enforced)

Even an unenforceable judgment lien can cause practical problems, including:

- Title company objections during a sale

- Delays in refinancing

- Negotiation leverage

- Clouded title issues

This is why judgment lien disputes often surface years later, long after the original lawsuit is forgotten.

7. Common Mistakes Judgment Creditors Make

Judgment creditors frequently assume:

- The judgment “automatically” creates a lien ❌

- Recording in one county is enough ❌

- Homestead property is fair game ❌

- Time does not matter ❌

In reality:

- Judgments can become dormant

- Abstracts can be defective

- Homestead protections can defeat enforcement

- Priority issues can wipe out value

8. What This Means If You Owe—or Are Owed—Money

If you owe a judgment:

- You may have more protection than you think

- Panic is often unnecessary

- Strategic planning matters

If you are owed a judgment:

- Proper lien creation is critical

- Timing and recording errors can destroy leverage

- Enforcement requires precision, not assumptions

Final Thoughts

In Texas, judgments do not equal liens, and liens do not equal collection.

The law draws sharp distinctions between liability, enforceability, and property rights—and those distinctions can mean the difference between leverage and nothing at all.

If a judgment affects your property, your business, or your ability to sell or refinance, getting accurate legal guidance early can prevent expensive mistakes later.

At David C. Barsalou, Attorney at Law, PLLC, we help clients navigate business, family, tax, estate planning, and real estate matters ranging from document drafting to litigation with clarity and confidence. If you’d like guidance on your situation, schedule a consultation today. Call us at (713) 397-4678, email barsalou.law@gmail.com, or reach us through our Contact Page. We’re here to help you take the next step.