Wrap mortgage loan financing—often called a wraparound mortgage—is a form of seller financing that remains legal in Texas but is strictly regulated. Governed primarily by Texas Finance Code Chapter 159, wrap mortgage loans can offer flexible financing solutions in certain real estate transactions, but they also carry significant legal risk if not structured correctly.

This article explains what a wrap mortgage loan is, why Texas regulates wrap financing, the basic requirements of Chapter 159, and when you may need a Texas real estate lawyer to protect yourself.

What Is a Wrap Mortgage Loan in Texas?

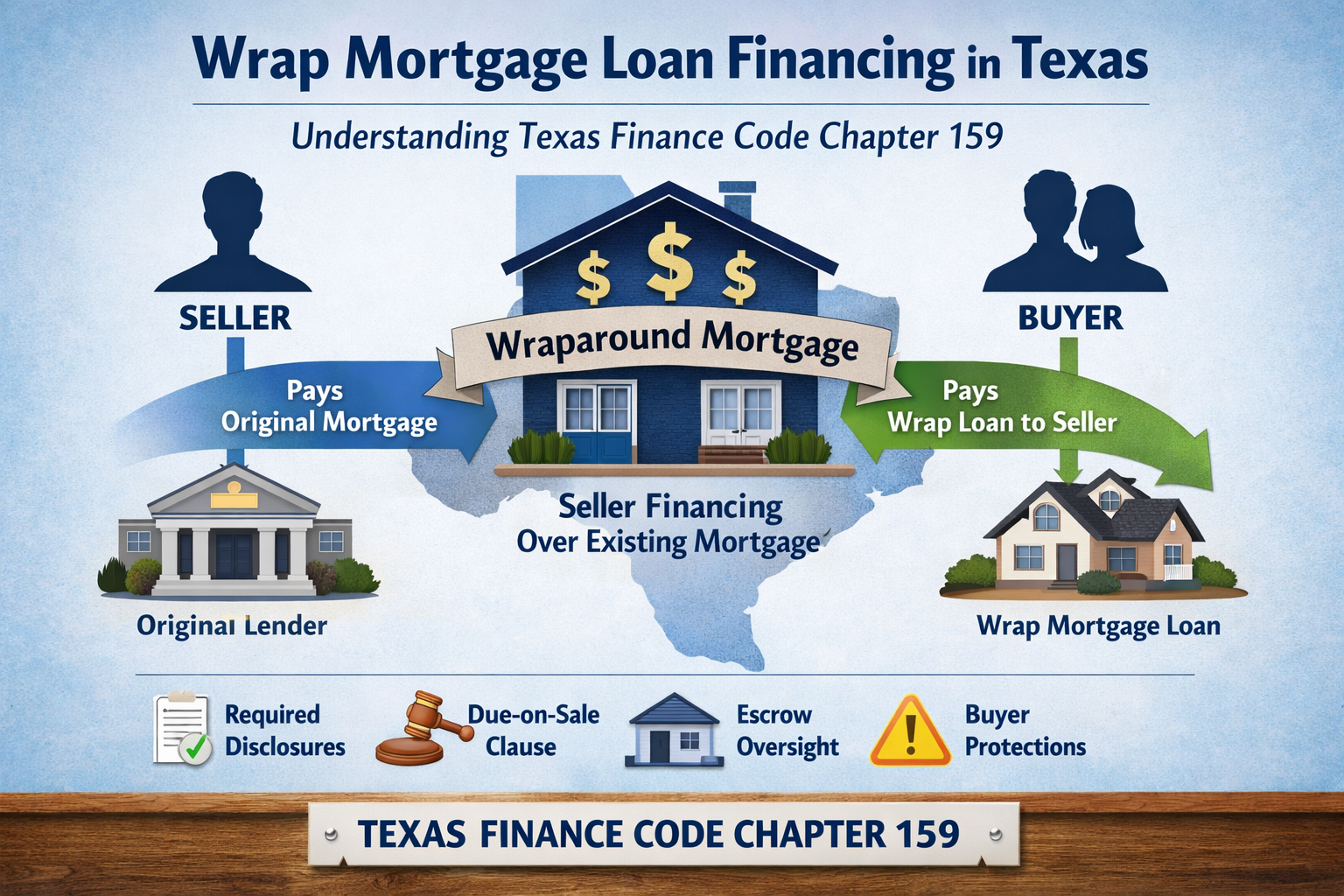

A wrap mortgage loan is a type of seller financing where the seller extends credit to the buyer without paying off the seller’s existing mortgage. Instead, the new loan “wraps around” the underlying mortgage.

In a typical Texas wrap mortgage transaction:

- The seller already has a mortgage on the property

- The buyer purchases the property using seller financing

- The buyer makes payments directly to the seller

- The seller continues paying the original mortgage lender

- The buyer’s payment usually includes the original mortgage payment plus additional interest or principal

Wraparound mortgages are commonly used when:

- Interest rates on existing loans are favorable

- Buyers cannot qualify for traditional financing

- Sellers want to generate monthly income

However, because the buyer does not directly control the underlying mortgage, Texas law imposes strict safeguards.

Why Texas Regulates Wrap Mortgage Financing

Wrap mortgage financing has a long history of abuse nationwide, particularly in residential transactions. Problems have included:

- Sellers collecting payments but failing to pay the underlying mortgage

- Buyers losing property through foreclosure despite making payments

- Hidden due-on-sale clauses that allowed lenders to accelerate loans

- Inadequate disclosure of risks to consumers

To address these concerns, the Texas Legislature enacted Texas Finance Code Chapter 159. The purpose of the statute is to:

- Protect residential buyers

- Increase transparency in seller-financed transactions

- Regulate wrap mortgage loan disclosures

- Prevent predatory real estate financing practices

Chapter 159 does not prohibit wrap mortgages—but noncompliance can be costly.

When Texas Finance Code Chapter 159 Applies

Texas Finance Code Chapter 159 generally applies to:

- Residential wrap mortgage loans

- Property used or intended to be used as the borrower’s principal residence

- Seller-financed transactions involving an existing lien or deed of trust

Many owner-occupied and small-investor transactions fall within the statute. Commercial properties and sophisticated transactions may be excluded, but those determinations are highly fact-specific.

Key Requirements Under Texas Finance Code Chapter 159

Chapter 159 imposes several core obligations on sellers who offer wrap mortgage loans in Texas.

Disclosure Requirements for Wrap Mortgage Loans

Sellers must provide written disclosures to buyers, including:

- The existence and balance of the underlying mortgage

- The interest rate and payment terms of the underlying loan

- Whether the lender has been notified or consented

- The risk of foreclosure if the seller fails to pay

- The presence of any due-on-sale clause

Failure to provide compliant disclosures can give buyers powerful legal remedies.

Notice to the Underlying Mortgage Lender

In many cases, the seller must provide notice to the existing mortgage lender that a wrap mortgage loan has been created. This requirement is critical because many mortgages allow acceleration if ownership or financing changes.

Ignoring this step can place both buyer and seller at risk.

Payment Handling and Loan Servicing Rules

Texas law may require that wrap mortgage payments be handled through:

- A third-party loan servicer

- Escrow-style payment processing

- Regular verification that the underlying mortgage is being paid

These rules exist to prevent sellers from diverting payments while leaving buyers exposed to foreclosure.

Buyer Remedies for Chapter 159 Violations

If a seller violates Texas Finance Code Chapter 159, the buyer may be entitled to:

- Rescission of the transaction

- Actual damages

- Statutory damages

- Attorney’s fees and costs

In some cases, a wrap mortgage that violates the statute can become financially disastrous for the seller.

Legal Risks of Wrap Mortgage Financing in Texas

Wrap mortgage loans appear simple but involve overlapping areas of law, including:

- Texas real estate law

- Texas finance and lending law

- Federal mortgage regulations

- Contract drafting and enforcement

- Tax consequences

Common legal pitfalls include:

- Triggering a due-on-sale clause

- Improper deeds of trust

- Invalid promissory notes

- Noncompliant disclosures

- Failure to use proper loan servicing

Because of these risks, wrap mortgage financing should never be treated as a “form deal.”

When You Should Contact a Texas Wrap Mortgage Lawyer

You should strongly consider speaking with a Texas real estate or finance attorney if:

- You are selling property using a wrap mortgage loan

- You are buying a home with seller financing

- The property is residential

- An existing mortgage remains in place

- You want to ensure compliance with Chapter 159

- A dispute or foreclosure risk has arisen

A lawyer can help determine whether Chapter 159 applies, draft compliant documents, coordinate disclosures, and protect your interests before significant money or property rights are at stake.

Final Thoughts on Wrap Mortgage Loans in Texas

Wrap mortgage financing remains a lawful but highly regulated financing method in Texas. Texas Finance Code Chapter 159 exists to protect buyers, ensure transparency, and impose accountability in transactions involving existing mortgage debt.

Whether you are a buyer or seller, understanding the legal framework surrounding wrap mortgages is essential. When properly structured, wraps can work—but when done incorrectly, they often lead to litigation, rescission, or foreclosure.

Legal guidance is not an afterthought in wrap mortgage transactions—it is often the difference between a successful deal and a costly mistake.

At David C. Barsalou, Attorney at Law, PLLC, we help clients navigate business, family, tax, estate planning, and real estate matters ranging from document drafting to litigation with clarity and confidence. If you’d like guidance on your situation, schedule a consultation today. Call us at (713) 397-4678, email barsalou.law@gmail.com, or reach us through our Contact Page. We’re here to help you take the next step.